History 1910-1988

In 1910, 10% of the population owned 90% of property; they were the private rental sector (PRS) at their height. Then, as Vicky explained, WW1 backdated the rent freeze to 1914 and various forms of rent control until 1988.

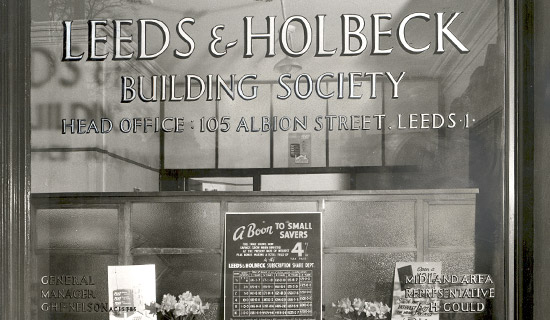

What rent control does to the PRS is reduce their needed yield to make the investment worth the hassle; otherwise, they’d put it in government bonds/stock markets, etc. So they got out, often selling to their tenants (one million properties were sold by landlords to their tenants from 1920-1930). This caused the once-high land values (remember the percentage of the final price) to crash. Along with government-regulated and subsidised mortgages (1% below the base rate) from highly regulated Mutual Building Societies (banks were not allowed to lend in the housing mortgage market post-1929; this reverted in 1986 via the ‘Big Bang’ of financial deregulation of the banks, financial services, and stock market) as well as something called stop/go policy (a whole other subject).

By the 1950s, land values had dropped to between 3% and 15% of the total value.

The government (of both colours, i.e. post-war consensus until 1979) ensured it stayed there to purchase land for New Towns and social housing—a win-win. All because rent control killed the commodified land value market.

By the late 1970s, the PRS had dropped to 7% from 90% (1910), and serious conversations were being held about whether it would cease to exist. Nobody cried out for more PRS, only for more social housing and potential ownership.