Advanced Conclusion

Economics is a social science, not a Newtonian one, as promoted by Adam Smith and the classical economists obsessed with the fashionable idea of the time (18th century) of new sciences based on the empiricism of repeatable experiments (Newtonianism), works for physics and chemistry. Still, the desperation for economics to be recognised in the same vein had led to this distorted view, as proven by the fact we cannot predict anything that has more than one variable with any accuracy, as John Maynard Keynes recognised when he got his fingers burnt in the 1929 crash, and leading to his theory of Uncertainty meaning we can only predict with any accuracy events very near future, the more distant the view the more inaccurate and therefore leading to guesswork and assumption. Otherwise, we would be able to make predictions using modelling. Still, we can’t, as too many variables lead to too many outputs, like the game of chess.

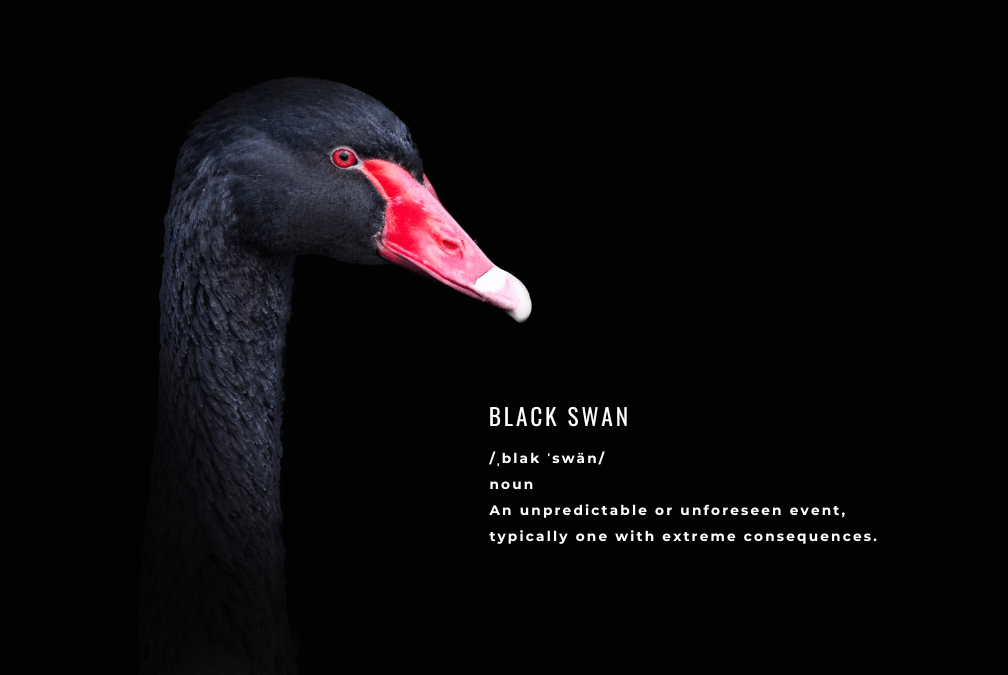

Thus, the concept of Black Swans (black swans didn’t exist until they did when they were found in South Australia in the 17th century). Nobody could’ve predicted this; thus, the term in economics is used in the context of a Black Swan Event that was thought impossible until it wasn’t.

Reference list

Parker (1937). THE PROPERTY TRADING BOARD GAME RULES THE GAME IN BRIEF. [online] Available at: https://902231.app.netsuite.com/core/media/media.nl?id=488686&c=902231&h=9fc37d8b226fe536bbfe&_xt=.pdf. Page 5