Chapter Three

So what’s stopping the government from creating more money if it’s just ‘money in the economy’?

On the one hand, we have an infinite resource and a limited resource on the other. When these get out of balance, we can either have inflated resources or money.

The role of the government is to see if there is enough of the ‘resource’ to absorb the issued currency and stop inflation. So if there is a shortage of products compared with the available money supply, you will need more money for x products. Suppose the government continues to issue money in such an environment. In that case, inflation will continue to rise as money becomes worthless due to its abundance compared to the increasing rarity of products.

We recently had product inflation due to an unexpected pandemic (Covid) and war (Ukraine being invaded by Russia). The money supply remained unchanged, but the products disappeared due to supply chain issues. All major initial inflation is caused first by ‘product shortages’ in the money supply; hyperinflation happens when even more money is issued in response to public pressure. The correct response is to;

a) If possible, increase product or

b) Extract the surplus money via targeted taxation

(note; interest rates are a regressive form of taxation that benefits those without debt and with savings).

The opposite of product inflation is product deflation.

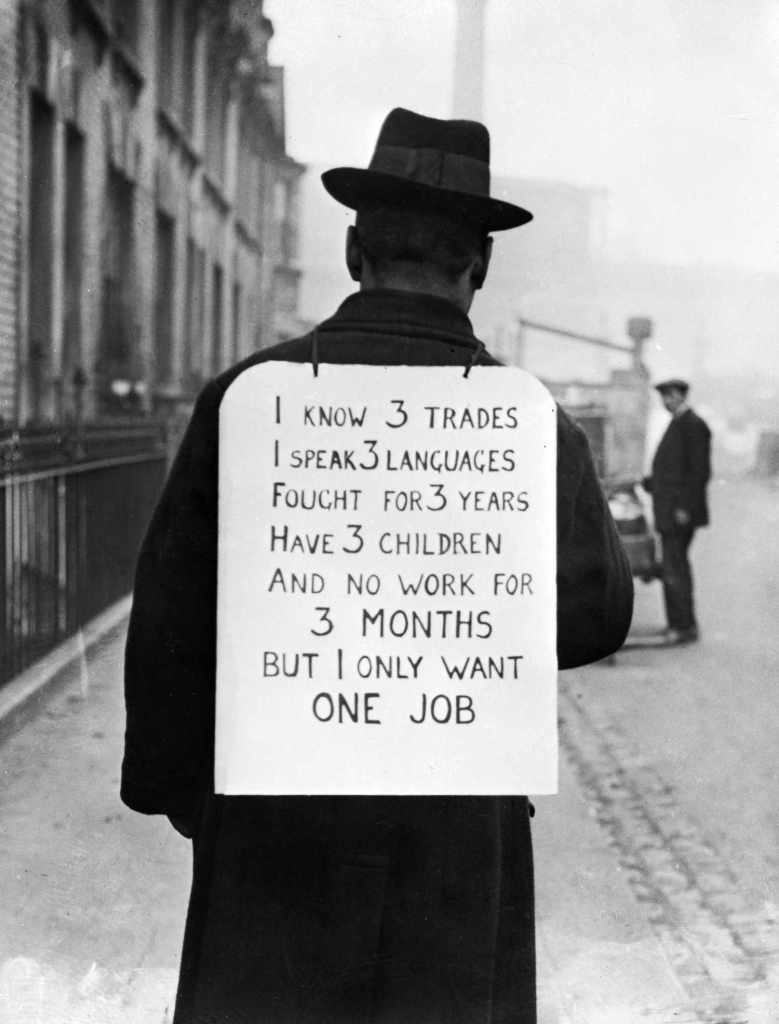

When there is a freeze of issuing new money, resources continue to be made. Money becomes a rarity and more expensive, leading to deflation where products become cheaper and cheaper to the point that it’s not worth creating them, which led to the Great Depression of the 1930s, where the UK government refused to issue new money to use the resources available, in this case;

Unemployed people

This inaction led to warehouses full of products that nobody could afford to buy, thus causing the former employers to go bankrupt; once this spiral began, only an increase in the money supply to employ the resource would halt the depression.

In the US, President F. D. Roosevelt (FDR, 1933-1945) issued new money, employed resources, and halted the depression, which became a boom even before WW2. This was the famous and, at the time, revolutionary ‘New Deal’.

The UK did the same, but the new money was pumped into the economy by the outbreak of war in 1939 when the unemployed were employed by the war machine.

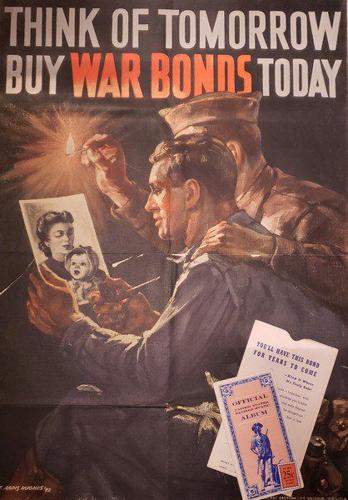

To control inflation, the UK and the US promoted government-issued interest-bearing war savings bonds during this war period.

Why?

To stop the inflation of products in short supply due to resources being diverted into the war machine. This ‘war bond’ was created to extract and lock up any surplus money from the economy with the promise of interest gained to be paid after the war when the war machine would revert to consumer production. The consumer products would absorb the surplus.

Money’s true value to an economy is when it is exchanged for a service or product; when saved, it no longer oils the wheels of the economy. Thus, Japan in the 2020s has a 250% ‘debt-to-GDP’ ratio (the same as the UK, just after WW2, which dropped to 30%, now 90%), which you would think would lead to high inflation, but there isn’t due to the older generation who (as in Germany) have a fear of hyper-inflation, so they save. To encourage people to spend, they have minus interest rates for savers, meaning that you lose the value of your savings if saved in a bank; thus, the theory goes, you better spend before it loses too much value!

Pingback: Impact of Rent Control on Land Values: A Critical Analysis | It's about people, stupid…