Why the great ‘gotcha’ question is the wrong question

Introduction

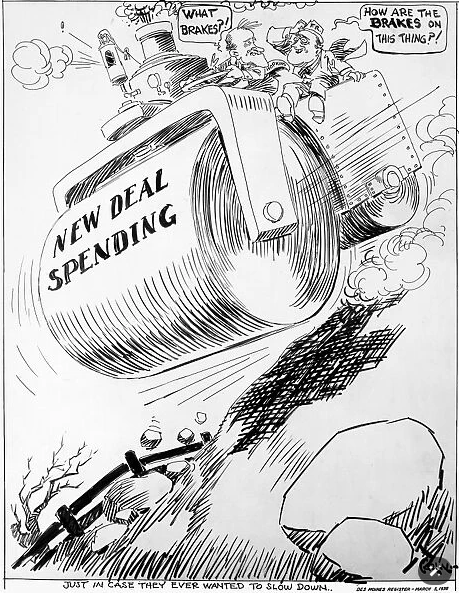

Back in 2017, I started looking at the housing issue and, in my naivety, started with ‘just build more houses’ to solve the issue of Economics 101 that is, if there is a shortage of supply, then the price will rise, reflecting that scarcity, if we build more then creating a surplus the price will fall. Concerning money needed for such investment from the centralised government of the day, I soon encountered the age-old question when it comes to spending money;

‘Well, how are you going to pay for it’

I’d reached a dead end before I’d even started! If I/we couldn’t pay for ‘it,’ whatever solutions I found would always be scuppered by this universal ‘gotcha’.

So then followed a dive into the economics of money, not what to do with it once we have it (which is a political and ideological choice) but where it comes from;

- Is it tax revenues?

- Is it government borrowing from banks via government-issued savings bonds?

- Is it gold reserves?

- Who are we actually in debt to?

- And if we paid it all back, would we have any money?

(The last point was far closer to the truth than I first realised).

In this blog entry, I will explain why finding ‘the money’ has never been the issue. The real issue is our natural finite resources, both from planet Earth and from us humans who inhabit it.

So, to save time, I’ve divided this into short chapters relating to page numbers. I recommend reading the whole article, rereading areas that are initially hard to comprehend, following links, and asking questions in the comment section. This article will evolve with feedback. It has taken me 7 years to understand this, so don’t worry if, at first, it all seems too hard to understand—it’s a paradigm shift.

This is a very brief overview. See recommendations in the Conclusion for further reading and viewing.

Chapter One, Page 2: What is money?

Chapter Two, Page 3: What about ‘The National Debt’?

Chapter Three, Page 4: So what’s stopping the government from creating more money

Chapter Four, Page 5: If the government can create money, why does it borrow it?

Conclusion, Page 6.